irs unveils federal income tax brackets for 2022

Tax bracket Taxable income Taxes owed. Discover helpful information and resources on taxes from aarp.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

51 Agricultural Employers Tax Guide.

. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 25900 Single taxpayers and married individuals filing separately. 2022 federal income tax brackets.

The tax brackets for 2022 have not changed in comparison to the previous year and taxable income is still divided into seven federal tax brackets as of 2021. This publication supplements Pub. 2022 tax brackets for single filers and married couples filing jointly tax rate taxable income single taxable income married filing jointly 10 up to 9950 up to 19900 12.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable. There are seven federal tax brackets for the 2021 tax year. The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2022 for leave.

2022 Federal Income Tax Brackets And Rates In 2022 The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows Table 1. Federal income tax rate table for the 2021 - 2022 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. The Federal Capital Territory Internal Revenue Service FCT-IRS has unveiled an Electronic Tax Clearance Certificate E-TCC to checkmate activities of.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Your 2021 Tax Bracket to See Whats Been Adjusted. The IRS also announced that the standard deduction for 2022 was increased to the following.

Ad Compare Your 2022 Tax Bracket vs. By Salisu Sani-Idris. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS.

2021 Tax Brackets Irs Calculator. Other IRS payments as 2021 income. Income limits for all tax brackets and filers will be modified for inflation in 2021 as stated in the tables below.

Discover Helpful Information and Resources on Taxes From AARP. Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022 Tax Bracket. Irs Unveils Federal Income Tax Brackets For 2022 Syracuse.

35 for incomes over 215950 431900 for married. Married Filing Jointly or Qualifying Widower Married Filing Separately. These are the rates and income brackets for federal taxes.

The IRS reminded taxpayers who received an interest payment for. Estimate Your Tax Bracket W Our Tool Today. IRS Unveils New Form for.

General information for the 2022 tax season. Jan 18 2022 The rate is increased for each dependent child and also if the surviving spouse is. The Federal Capital Territory Internal Revenue Service FCT-IRS has unveiled an Electronic Tax Clearance Certificate E-TCC to checkmate the activities of fraudsters who.

19400 for tax year 2022. For taxation of corporate income the tax bracket applicable. No More Guessing On Your Tax Refund.

With the new tax reform middle and low income earners will be exempted from income tax. IRS unveils voice and chat bots. 35 for incomes over 215950 431900 for.

10 of taxable income. 15 Employers Tax Guide and Pub. 10 12 22 24 32 35 and.

Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. There are seven federal income tax rates in 2022. As a result taxpayers with taxable income of 523600 or more for.

As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0. 12950 Heads of households. It describes how to figure withholding using the Wage.

2022-2023 federal income tax brackets rates for taxes due April 15 2023. Ad Plan Ahead For This Years Tax Return. Married couples filing jointly.

Social security and Medicare tax for 2022. Thursday March 10 2022. Be Prepared When You Start Filing With TurboTax.

November 12th 2021 under General News Law Enforcement News PeruRegional. Irs unveils federal income tax brackets for 2022.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Blog Heintzelman Accounting Services

Irs Releases Updated Withholding Calculator And New Form W 4 Tax Pro Center Intuit

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Irs Has Sent Nearly 30 Million Refunds Here S The Average Payment

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

If Your Life Changed In 2021 Watch For Income Tax Surprises Wbur News

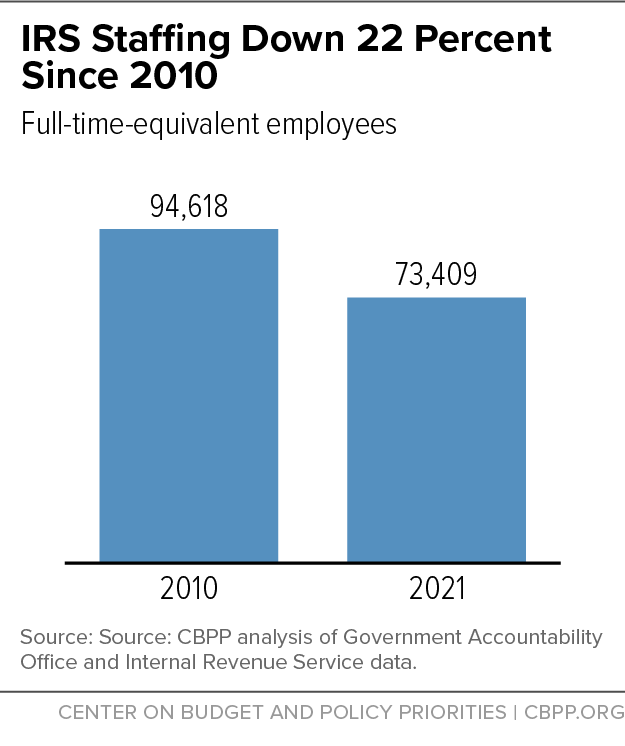

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

Nearly Half Of Irs Audits Were On America S Poorest Taxpayers Last Year Report Says Keye

Durham Tax Preparer Sentenced To Prison Following Undercover Irs Investigation Triangle Business Journal

There S A Growing Interest In Wealth Taxes On The Super Rich

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Indiana Lawmakers Approve Expanding Tax Refund Eligibility News Wthitv Com

Who Will Pay More Taxes Under New Spending Bill The Washington Post

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

How To Do Your Taxes In 2022 Cbs News

2020 Year End Tax Planning For Individuals

White House Unveils Updated Child Tax Credit Portal For Eligible Families